Stock Price Forecasting using LSTM

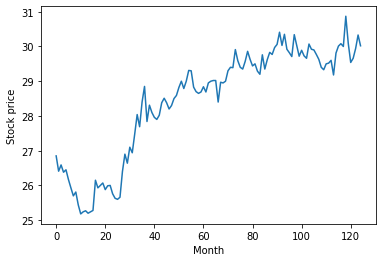

LSTM has been very useful to predict time series data. We have previously discussed about the time series forecasting using Pytorch Deep Learning framework in this time series forecasting blog. In this article, we will demonstrate how to apply the LSTM to predict stock price. We will get our 6 months DBS stock price from Yahoo Finance.

The LSTM model for the stock price is shown below

class LSTM(nn.Module):

def __init__(self, num_classes, input_size, hidden_size, num_layers):

super(LSTM, self).__init__()

self.num_classes = num_classes

self.num_layers = num_layers

self.input_size = input_size

self.hidden_size = hidden_size

self.seq_length = seq_length

self.lstm = nn.LSTM(input_size=input_size, hidden_size=hidden_size,

num_layers=num_layers, batch_first=True)

self.fc = nn.Linear(hidden_size, num_classes)

def forward(self, x):

h_0 = torch.zeros(self.num_layers, x.size(0), self.hidden_size)

c_0 = torch.zeros(self.num_layers, x.size(0), self.hidden_size)

# Propagate input through LSTM

_, (h_out, _) = self.lstm(x, (h_0, c_0))

h_out = h_out.view(-1, self.hidden_size)

out = self.fc(h_out)

return outTo form the data, we can define a sliding window to scan the training data

def sliding_window(data, seq_length):

x = []

y = []

for i in range(len(data)-seq_length-1):

_x = data[i:(i+seq_length)]

_y = data[i+seq_length]

x.append(_x)

y.append(_y)

return np.array(x),np.array(y)To test the model, we can split the time series data into training and. testing set

train_size = int(len(y) * 0.67)

test_size = int(len(y)) - train_size

dataX = torch.Tensor(np.array(x))

dataY = torch.Tensor(np.array(y))

trainX = torch.Tensor(np.array(x[0:train_size]))

trainY = torch.Tensor(np.array(y[0:train_size]))

testX = torch.Tensor(np.array(x[train_size:len(x)]))

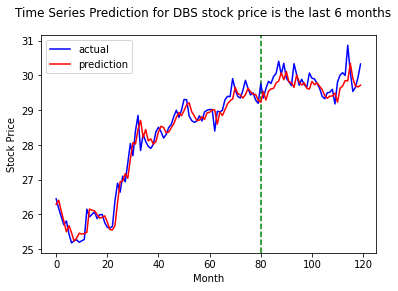

testY = torch.Tensor(np.array(y[train_size:len(y)]))We can plot the actual and predicted stock prices using scikit learn and matplotlib libraries

train_predict = lstm(dataX)

data_predict = train_predict.data.numpy()

dataY_plot = dataY.data.numpy()

data_predict = sc.inverse_transform(data_predict)

dataY_plot = sc.inverse_transform(dataY_plot)

plt.axvline(x=train_size, c='g', linestyle='--')

plt.plot(dataY_plot,'b',label='actual')

plt.plot(data_predict,'r',label='prediction')

plt.suptitle('Time Series Prediction for DBS stock price is the last 6 months')

plt.xlabel('Month')

plt.ylabel('Stock Price')

plt.legend()

plt.show()LSTM

The result shows that LSTM model is extremely good in predicting the stock price.

References:

Relevant Courses

July 18, 2021